Delinquency has a detrimental effect on your credit score rating.

Delinquency has a detrimental effect on your credit score rating. Payment historical past is likely certainly one of the largest components influencing credit score scores, and missed payments can lower your score significantly. A decrease credit rating can make it challenging to safe favorable lending terms sooner or later, which is why it's necessary to deal with delinquency issues as soon as potent

Understanding No-Visit Loans

No-visit loans are designed to get rid of the necessity for in-person visits to a lending institution. Borrowers can full the entire application course of on-line from the comfort of their properties. This type of lending is especially appealing to busy professionals, individuals with mobility challenges, or those that simply choose a more handy approach to borrowing. Many institutions offer varied kinds of no-visit loans, ranging from personal loans to short-term cash advan

Despite their rising prominence, there are several misconceptions about Day Laborer Loans that can deter potential borrowers. One widespread myth is that every one day labor loans are predatory and laden with exorbitant interest rates. While some lenders may charge excessive charges, many reputable choices exist that offer truthful phra

Another issue is the doubtless higher interest rates offered by some no-visit loans in comparison with conventional loans. Due to the comfort and velocity of access, debtors could discover themselves facing larger overall prices if they do not seem to be diligent in buying round and evaluating provides from various lend

Additionally, borrowers must be clear about the mortgage terms, including rates of interest, payment schedules, and redemption choices. Knowing these details helps in making an knowledgeable choice and avoiding unexpected monetary burdens down the r

Delinquent loans can drastically impression a borrower’s credit score rating, resulting in a better interest rate for future loans, if they're ready to qualify at all. It may even result in the lender pursuing collection options or foreclosures in severe cases, notably with secured loans similar to mortgages. Therefore, understanding how delinquency impacts personal finance is essential for accountable borrow

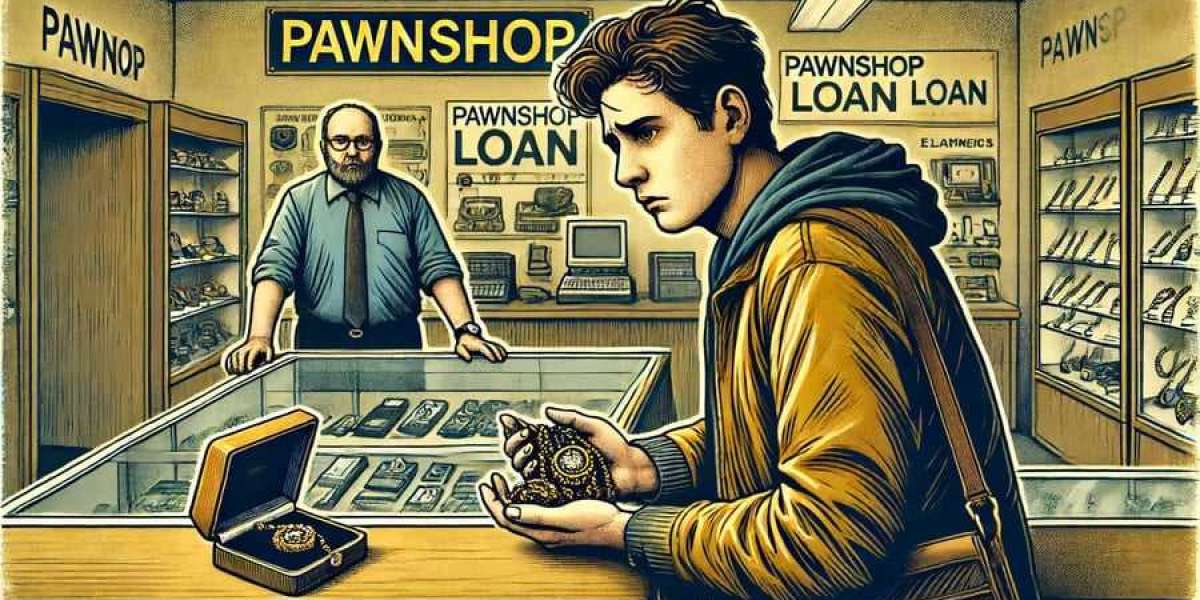

Before continuing with a pawnshop mortgage, debtors should consider a quantity of factors to make sure it aligns with their monetary situation. Firstly, understanding the worth of the item being pawned is essential. Taking the item to multiple outlets for appraisals can present perception into its true price and result in a better d

Pawnshop loans is usually a sensible financial solution for those in want of quick cash. Utilizing personal possessions as collateral, this option permits people to secure funds with out extensive credit checks or lengthy approval processes. For many, pawnshops provide an environment friendly way to handle short-term monetary challenges, making it a crucial matter to discover. In this article, we are going to delve into the intricacies of pawnshop loans, their advantages and downsides, and the essential components that debtors want to consider. Additionally, we will introduce BePick, an informative platform dedicated to offering insights and reviews on pawnshop loans, equipping people with the information they n

Disadvantages of No-Document Loans

Despite the clear advantages, no-document loans include their very own set of challenges. One significant downside is the elevated rates of interest. Because lenders assume extra risk in offering loans with out thorough documentation, they usually cost greater rates compared to conventional mortgage produ

Causes of Delinquent Loans

The reasons behind delinquent loans are sometimes multifaceted. Financial difficulties are maybe the most common cause, stemming from surprising bills similar to medical bills or vehicle repairs. In some conditions, borrowers may face monetary challenges as a end result of job loss or reduced earnings, which makes it difficult to maintain up with month-to-month

Loan for Unemployed repayments. Additionally, poor budgeting and monetary planning can lead to an accumulation of debt, increasing the probability of delinque

If your mortgage becomes delinquent, promptly evaluate your financial situation and set up a plan. Contact your lender to debate choices for restructuring repayments or in search of a deferred cost plan. It’s important to communicate overtly to prevent additional consequences. Consistently making funds consistent with any new agreements is vital to enhancing your financial stand

Moreover, enhancing monetary literacy is key. By educating themselves about their loans and finance in general, borrowers could make extra knowledgeable choices and recognize the implications of their financial selections, ultimately avoiding delinque

Another misconception is that making use of for a Day Laborer

Loan for Delinquents harms one’s credit score score. Many lenders do not carry out credit score checks, allowing people to acquire loans without any adverse results on their credit histories. It is important to differentiate between various lenders and their practices relating to credit score inquir

스포츠 베팅은 어떻게 작동합니까?

스포츠 베팅은 어떻게 작동합니까?

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup