Lastly, actual property can be a valuable technique of diversification in an investment portfolio.

Lastly, actual property can be a valuable technique of diversification in an investment portfolio. By together with property as an asset class, investors can scale back general portfolio threat while gaining exposure to a market that usually behaves differently than stocks and bonds. This steadiness can result in extra secure long-term financial developm

Another advantage is that the application course of is often much easier than traditional loans. Many lenders do not require intensive paperwork, making it accessible to a broad vary of candidates, even those with less-than-stellar credit score histories. Ultimately, these elements make Card Holder Loans a compelling alternative for these in need of economic h

BePick is an invaluable useful resource for anyone looking for detailed data and critiques about actual property loans. Their platform offers a complete database that aids users in evaluating numerous loan choices, understanding completely different lender insurance policies, and accessing expert insights. Whether you’re unfamiliar with the mortgage process or a seasoned investor, BePick can present tailor-made info that matches your ne

Furthermore, utilizing out there credit can negatively impact one's credit rating, particularly if the cardholder approaches or exceeds their credit score restrict. This can result in lower credit score scores and tougher future borrowing alternati

BePick not solely offers essential data but in addition features expert insights into the nuances of Card Holder Loans and their implications. This can significantly scale back the guesswork involved find the proper mortgage for your needs. Whether you're looking for

websites tips on accountable borrowing or wish to evaluate lenders, BePick has all the tools necess

Another false impression is that Daily Loans are just for people with poor credit. While conventional lenders may favor those with higher credit score scores, numerous lenders specializing in Daily Loans consider functions primarily based on a broader set of criteria, making these loans accessible to many individuals. Understanding these misconceptions may help borrowers make better-informed decisi

The amounts for Daily Loans tend to differ based mostly on the lender and the borrower’s monetary profile. Borrowers can sometimes entry small quantities of cash ranging from a couple of hundred to a few thousand dollars. However, it is important to notice that while these loans present immediate relief, they usually come with higher rates of interest and fees. Therefore, understanding the whole price of borrowing is paramo

n Interest rates for personal loans vary extensively primarily based on credit score scores, lender policies, and market circumstances. Typically, charges might range from round 5% to 36% APR, with decrease rates typically obtainable to those with good to glorious credit score. Always compare charges and skim the mortgage phrases fastidiously to seek out one of the best d

Consolidation loans are notably in style amongst these looking to merge multiple debts right into a single payment, usually with a lower rate of interest. Meanwhile, medical loans might help cowl unexpected healthcare bills. Home enchancment loans specifically cater to householders seeking to finance renovations, while trip loans permit individuals to plan and fund their dream getaways without straining their price ra

There are various kinds of actual estate loans, every designed to cater to particular wants. The most typical types embrace conventional loans, FHA loans, VA loans, and USDA loans, every with unique necessities and advantages. Conventional loans are typically offered by non-public lenders and wouldn't have government backing, whereas FHA loans are federally insured and designed to assist first-time homebuyers. On the other hand, VA loans cater to veterans and lively navy members, offering favorable terms without requiring a down c

In addition, BePick frequently updates its content material to reflect the newest tendencies in the real estate

Loan for Office Workers market. Users can discover articles, guides, and market analyses that assist them stay knowledgeable, enabling assured selections. With entry to useful instruments and professional reviews, BePick is dedicated to empowering debtors all through their actual estate jour

How to Apply for an Employee

Student Loan The utility process for worker loans can differ from one organization to another, however usually, it is fairly simple. Employees often start by filling out a mortgage application form that outlines the quantity they want to borrow and the purpose of the mortgage. This form typically features a part asking for details about their current financial scena

Choosing the right real estate mortgage entails evaluating several components, together with your financial situation, long-term goals, and private preferences. Consider the kind of mortgage that best suits your needs, whether or not or not it's a fixed-rate mortgage for stability or an adjustable-rate mortgage for lower preliminary payments. Consulting with financial advisors or utilizing platforms like BePick can assist you in evaluating lenders and discovering probably the most suitable opti

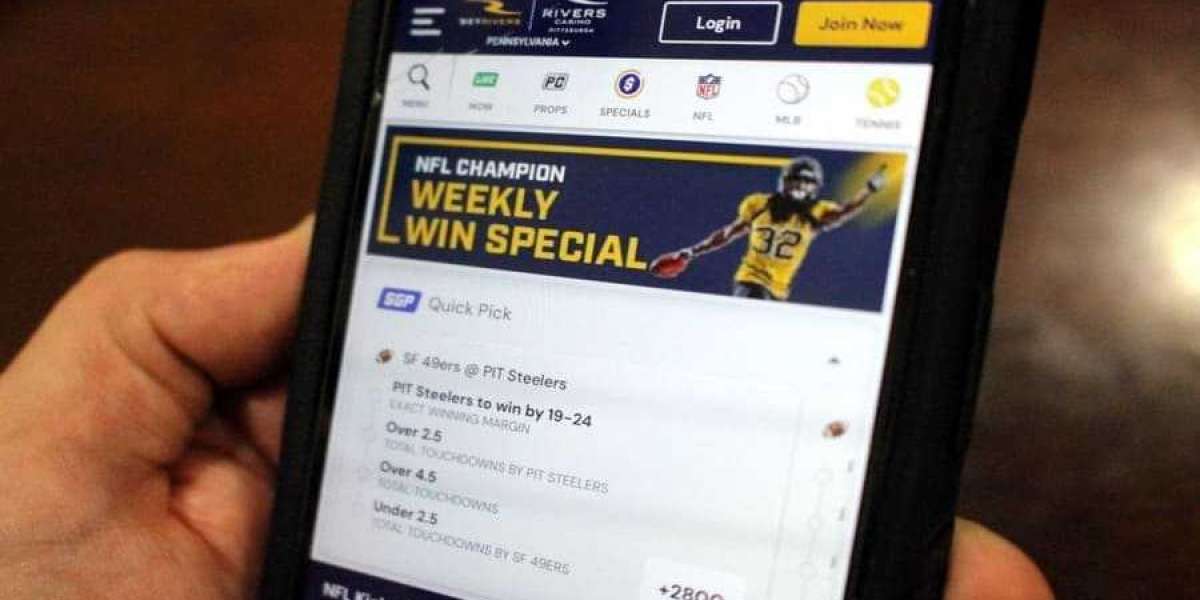

스포츠 베팅은 어떻게 작동합니까?

스포츠 베팅은 어떻게 작동합니까?

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup