The major objective of an Emergency Fund Loan is to assist cowl bills that cannot be postponed. This can embrace medical bills, car repairs, or residence upkeep costs that arise unexpectedly.

The major objective of an Emergency Fund Loan is to assist cowl bills that cannot be postponed. This can embrace medical bills, car repairs, or residence upkeep costs that arise unexpectedly. Many lenders offer these loans with a straightforward application course of, which can typically be accomplished on-line, resulting in expedited fund

When it comes to employee loans, understanding the authorized laws is imperative. Employers need to comply with regulating our bodies governing mortgage agreements and employment practices. This compliance consists of being transparent about the phrases, situations, and potential repercussions of taking out a loan with the corpor

Furthermore, lenders providing Housewife Loans often offer custom-made compensation plans, which can ease the stress of repayment. Many loans come with flexible payment phrases that accommodate the often fluctuating monetary situations that housewives could encounter. This flexibility ensures that debtors can handle their

Mobile Loan repayments whereas juggling other responsibilit

In addition to mortgage comparisons, 베픽 supplies instructional content material about the borrowing process. Users can learn in regards to the implications of taking out a same-day loan, together with potential dangers and best practices for profitable reimbursement. This data empowers shoppers to make well-informed monetary decisi

Another profit is the accessibility of these loans. Many lenders have lenient qualification criteria, making it possible for people with less-than-perfect credit scores to secure funding. This inclusivity permits borrowers going through monetary difficulties to find solutions without extreme obstac

Accessibility is another important advantage. Many lenders cater specifically to people with less-than-perfect credit, making it possible for a wider audience to acquire needed funds during emergencies. This inclusivity is essential throughout times of crisis, because it ensures that financial assist is available to those that need it m

In today's quickly changing financial landscape, many housewives are exploring the choice of loans to manage their family finances, invest in opportunities, or support private initiatives. The concept of a "Housewife Loan" caters particularly to these individuals, offering tailor-made options that accommodate their distinctive monetary situations and aspirations. Today, we are going to delve into what Housewife Loans entail, how they perform, and why they're becoming increasingly well-liked. Additionally, we'll introduce you to a priceless resource—BePick—that provides complete info and insights on Housewife Loans, permitting girls to make informed selections concerning their monetary pa

Understanding Same-Day Loans

Same Day Loan-day loans are designed to provide debtors with quick entry to money, usually within 24 hours of making use of. This monetary product is especially interesting to these dealing with surprising expenses, similar to medical bills, automotive repairs, or emergency house repairs. Borrowers can profit from a streamlined utility process that often requires minimal documentation, making it accessible for people who could not have impeccable credit score sco

Furthermore, employers ought to be aware of the implications of their lending practices on employee morale and authorized tips. There may be restrictions on how much of an employee's salary may be deducted for mortgage reimbursement, in addition to issues for the way these loans might affect an employee’s credit score stand

While employee loans offer many benefits, there are essential components to consider before applying. One of the necessary thing features is the potential influence on your payroll. Regular deductions from an employee’s paycheck can have an result on total money circulate, particularly if a quantity of loans are ta

베픽 is devoted to helping users navigate through the complexities of economic options out there today. By offering detailed assessments of assorted lenders, mortgage varieties, and the general mortgage expertise, customers can gain invaluable insights into making the proper borrowing choi

However, it's essential to know the phrases of those loans. While the short entry to cash is engaging, same-day loans often come with larger rates of interest compared to commonplace loans. Borrowers should weigh the urgency of their monetary want against the price of borrowing to make knowledgeable choices about whether to proc

Additionally, the ease of obtaining these loans would possibly tempt people to borrow greater than they can afford to repay. This can lead to a cycle of debt, where debtors depend on new loans to repay old ones, doubtlessly worsening their financial state of affa

The Role of BePick in Loan Education

BePick serves as a useful resource for housewives exploring loan choices. The website offers a plethora of data on Housewife Loans, together with detailed critiques of various lenders, tips about

Loan for Housewives functions, and guidance on managing debt. By providing insights into each the advantages and potential pitfalls of different loan products, BePick enables users to make informed financial selecti

스포츠 베팅은 어떻게 작동합니까?

스포츠 베팅은 어떻게 작동합니까?

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

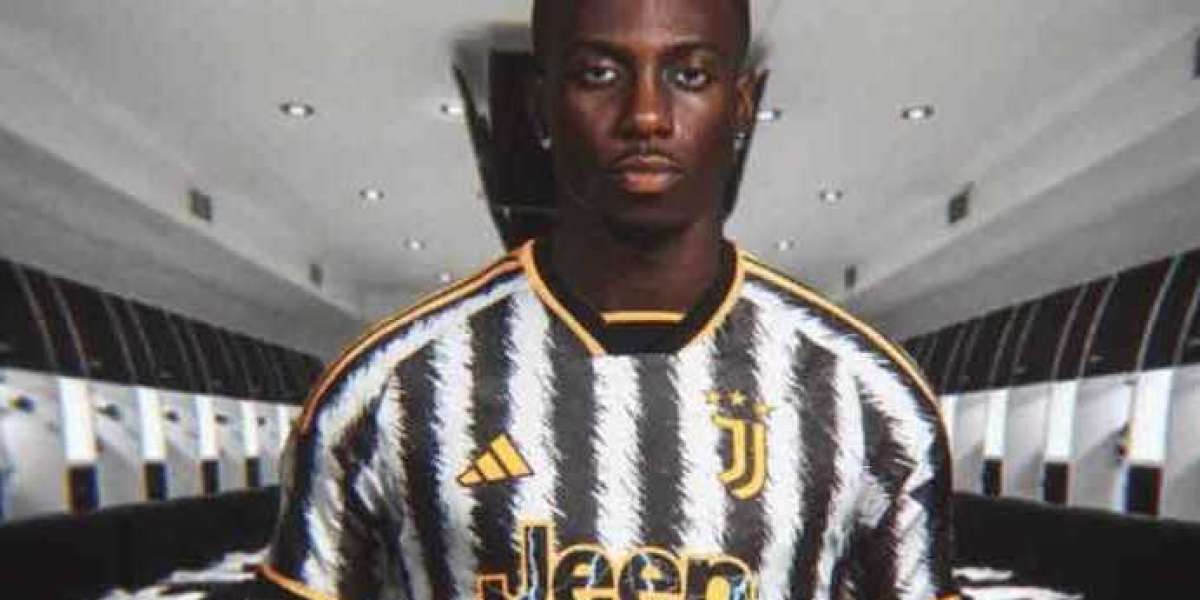

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup