Why Use 베픽 for Personal Loans?

베픽 is an invaluable resource for people seeking personal loans.

Why Use 베픽 for Personal Loans?

베픽 is an invaluable resource for people seeking personal loans. This website supplies comprehensive particulars on various

Same Day Loan choices, serving to borrowers perceive the complexities of the personal

Mobile Loan market. From user-friendly critiques to in-depth guides, 베픽 equips users with the necessary information to make informed selecti

To make an knowledgeable determination about an Additional Loan, assess your monetary situation, examine offers from numerous lenders, and skim all phrases and situations completely. Understanding the loan’s prices and reimbursement options will help mitigate potential dang

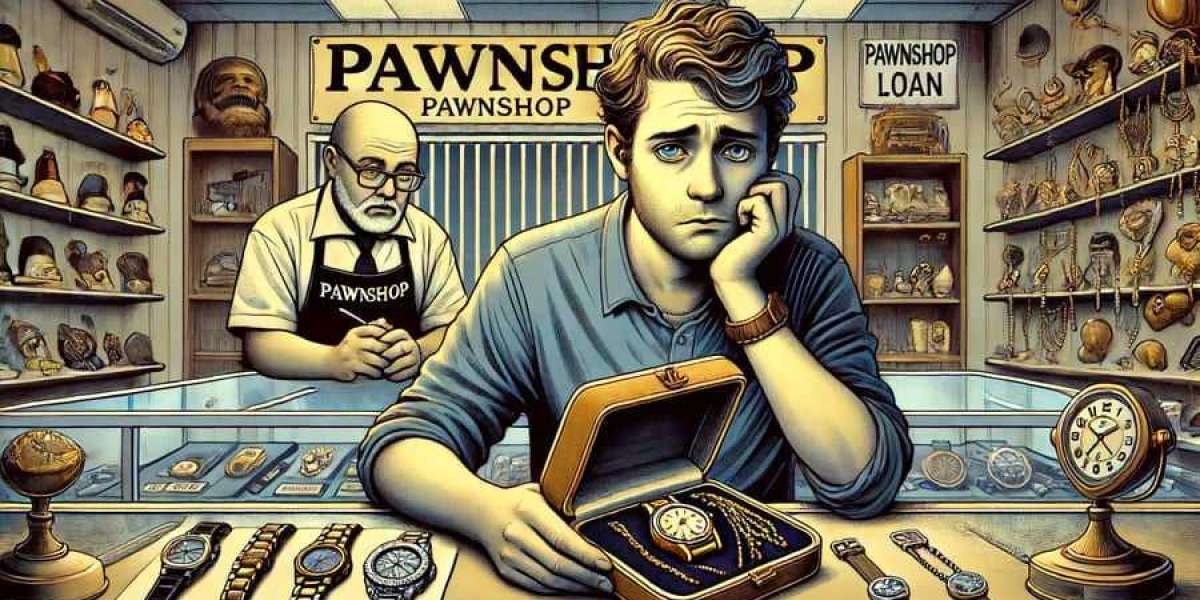

One of the important thing advantages of pawnshop loans is that they don't require a credit check, making them accessible to people with poor credit histories. Furthermore, the approval course of is quick and easy, allowing borrowers to obtain money in hand within hours, which can be essential in emergenc

Loan Terms and Conditions

When applying for a pawnshop loan, it is essential to totally review the mortgage terms and situations. These can differ considerably from one pawnshop to a different. Typically, the phrases include the interest rate, compensation schedule, and penalties for missed payments. **Interest rates** on pawnshop loans can be substantially greater than these of typical loans, and borrowers must be positive that they will repay the mortgage inside the specified per

The concept behind Card Holder Loans is straightforward. By using the borrowed quantity, people can cover surprising expenses, similar to medical payments or urgent home repairs. The flexibility of reimbursement phrases adds to their attraction, permitting debtors to choose a plan that suits their financial capabilit

Another choice is to consolidate or refinance loans. This course of can scale back month-to-month payments and in the end decrease rates of interest, making it easier to make amends for late quantities. It requires cautious evaluation of the terms to ensure it's financially benefic

Additionally, consider the pawnshop's stock and expertise in valuing the gadgets you intend to pawn. Establishing a relationship with a trustworthy pawnshop can benefit repeat clients, as they may obtain higher valuation on their gadgets and extra favorable loan phrases in the fut

How to Apply for a Card Holder Loan

Applying for a Card Holder Loan is a relatively straightforward process. It sometimes begins with assessing your present bank card scenario, together with the available credit restrict and general credit score. This self-assessment provides you with a transparent thought of what you probably can bor

Pawnshop loans could be suitable for people who want instant cash and have priceless objects to sell. However, they will not be your best option for those dealing with a long-term monetary disaster or wishing to avoid high-interest charges. Evaluating one’s financial scenario is vi

How 베픽 Can Help with Card Holder Loans

ベ픽 is a leading useful resource for people looking for details about Card Holder Loans. The platform presents detailed guides and reviews to help customers understand the varied aspects of these loans, making the borrowing course of much smoot

Furthermore, borrowers should be cautious of predatory lending practices, which can embrace extremely high-interest charges or hidden fees. Conducting thorough analysis and consulting sources on ベ픽 may help people identify trustworthy lenders and avoid potential pitfa

Moreover, small loans can considerably profit individuals and not utilizing a stable credit historical past. Some lenders give attention to the applicant's capability to repay rather than solely counting on credit score scores. This inclusivity makes small loans a well-liked choice for many looking to set up or rebuild their credit profi

After deciding on a lender, you will need to complete an software form. Be prepared to offer information about your revenue, present debts, and the explanation for the mortgage. The lender will review your software and may approve it relying on your creditworthiness and the available credit score on your c

Moreover, it’s prudent to borrow only what you want. Small loans may be a wonderful answer for quick financial challenges, but overextending your self can result in issues. Therefore, contemplate different options if the required amount feels extr

In addition to accessibility, small loans provide flexibility in phrases of compensation. Borrowers can typically choose repayment schedules that best match their financial circumstances, permitting for manageable month-to-month payments. This adaptability can help forestall financial strain through the reimbursement per

While necessities differ amongst lenders, a credit rating of 600 or higher is generally considered acceptable for personal loans. However, greater scores usually result in better rates of interest and phrases. It is advisable to verify your credit score score earlier than making use of and make enhancements if nee

스포츠 베팅은 어떻게 작동합니까?

스포츠 베팅은 어떻게 작동합니까?

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

Golden Knights vinder anden kamp i træk, Stanley Cup-titel i sigte

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

AC Milan vinder 3-1 over Verona efter dobbelt mål af Rafael Leão

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Nacho još nije odgovorio na ponudu Real Madrida za produženje ugovora i mogao bi otići nakon sezone

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup

Enzo scoort bij debuut Chelsea keert Wimbledon met 2-1 en gaat door naar derde ronde League Cup